The Crypto Bull Run Still Hasn't Started—and Might Not For A While

The crypto market—a glittering digital funfair where fortunes are made faster than a viral cat video and lost quicker than a politician's principles. You've got Bitcoin strutting like the king of the castle, altcoins scampering around like eager sidekicks, and the whole shebang fueled by the Federal Reserve's money-printing antics. But here's the twist that's got everyone from X influencers to your friend that told you about an obscure memecoin that he says will be the next “Ethereum Killer!”:

The crypto bull run isn't over because it never began.

That's right—despite the hype, the memes, and the occasional spike that makes you think "this is it," we're still in the warm-up act, waiting for the main event. There's a mountain of evidence for this, stacked higher than the U.S. national debt (which, spoiler, is a key player here).

Let's start with the myth-busting basics: what truly sparks a crypto bull run isn't Bitcoin's halving—that quadrennial event where mining rewards get slashed like a budget airline's legroom. Sure, it's a nice story for the crypto faithful, like telling kids the tooth fairy pays in digital gold, but most coins don't even have halvings.

The real culprit is the money-printing frenzy, cranked up to manage the national governments’ colossal debt load.

Louder for the people in the back: MONEY PRINTING AND GLOBAL M2 GROWTH IS WHAT CAUSES THE BULL RUN.

Not the halving.

Not the tech.

Not the marketing.

Not the communities.

Not government strategic reserves.

Not digital asset treasuries.

Only money printing.

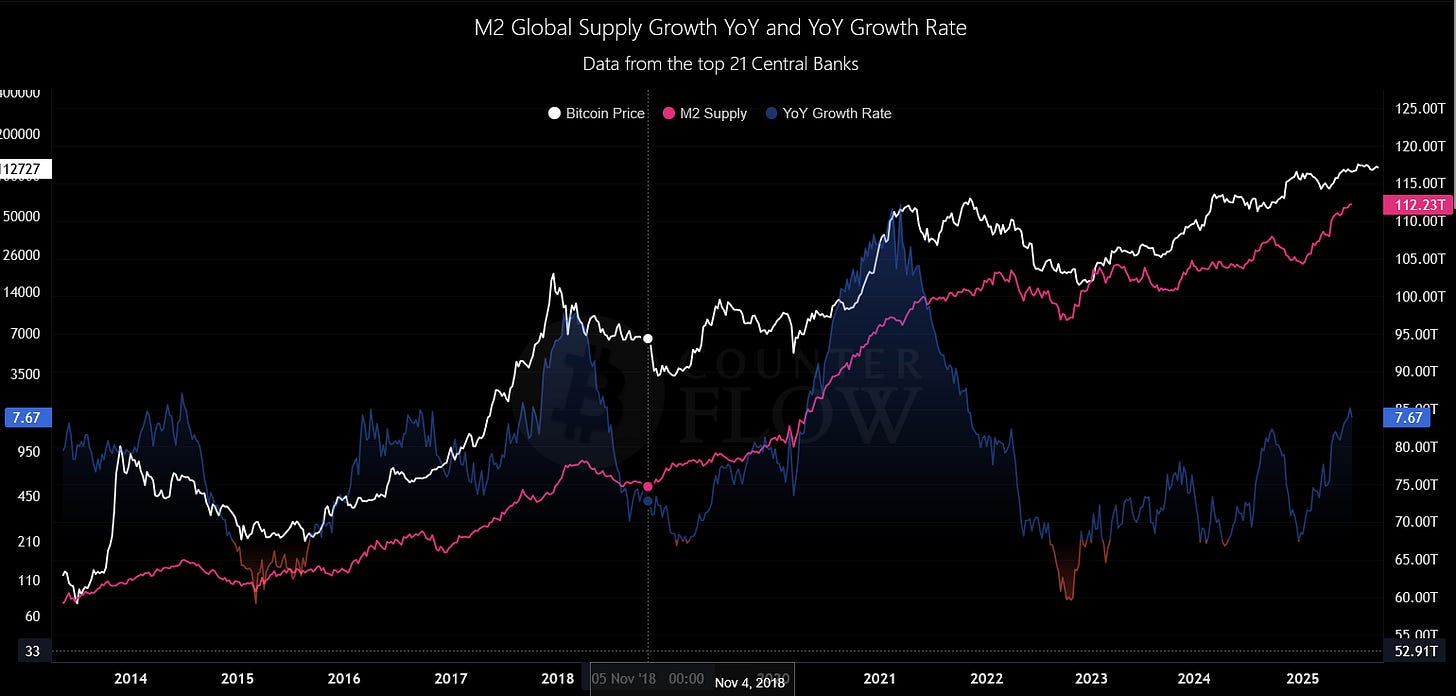

Here’s the proof:

So why does the money printing occur?

Every four years or so (the debt cycle this time around is five years because of long-dated maturities), about a third of the national debt matures and needs refinancing, like a bad loan shark demanding his cut on a schedule. To keep things palatable and avoid yields spiking like a bad fever, the Fed fires up the presses, flooding the system with dollars that weaken the currency and push investors into riskier assets like crypto. It's not some mystical alignment of blockchain stars; it's economics dressed in a clown suit, with the government's debt cycle as the ringmaster. Without this liquidity injection, crypto stays in the doldrums, waiting for the cash wave to hit.

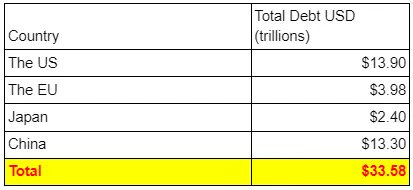

This is the amount of global sovereign debt that is being reissued this time around:

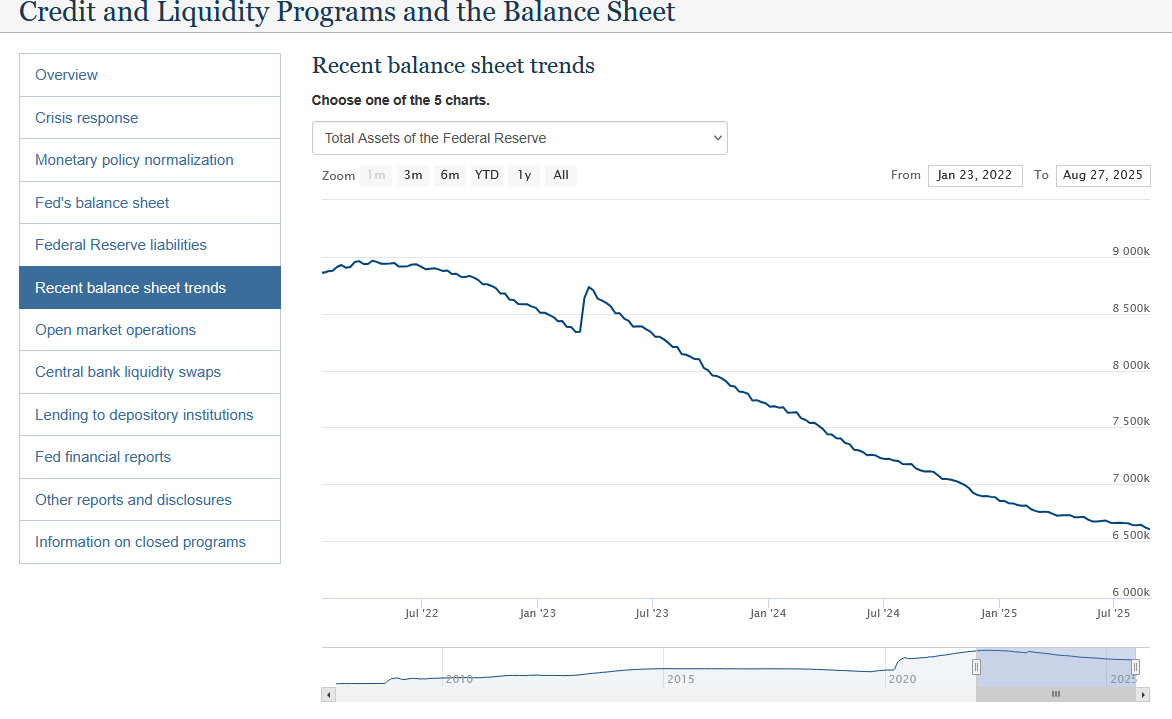

As of 10/6/2025, there's been no money printing or quantitative easing (QE) this cycle—quite the opposite, in fact. The Fed's still in quantitative tightening (QT) mode, offloading Treasuries from its balance sheet like a decluttering guru on a mission, shrinking liquidity rather than expanding it. That's the antithesis of a bull run spark—it's like trying to ignite a bonfire by dousing it with water. QE is the flood of cash that fuels speculation, turning dollars into rocket fuel for assets like Bitcoin. Without it, we're in a holding pattern, with crypto prices treading water like a swimmer in a pool of uncertainty. Projections suggest QT might end in early 2026, flipping to QE as debt pressures mount, but until then, the bull's still in the pen, snorting impatiently.

Look at the Federal Funds rate versus the 10-year Treasury yield for another glaring sign we're pre-bull. As of October 6, 2025, the Funds rate—the Fed's benchmark for overnight lending—is at 4.25%, while the 10-year yield's at 4.15%. This inverted yield curve—short-term rates higher than long-term—has been a staple before every crypto bull market, signaling tight money and recession jitters.

But the real kickoff doesn't happen until they flip: the Funds rate drops below the 10-year, unleashing easier credit like opening the floodgates on a dam. We're still in the "brace yourself" phase, with crypto languishing like a festival tent in a drizzle. This inversion's a warning light, not the green flag—until it uninverts, the bull's just warming up its engines.

When Treasury yields are high—over 3.6% is the "red zone" these days, and at 4.23%, they're screaming—it’s the market's way of saying, "Even safe investments like bonds are too spicy right now; nobody wants 'em." High yields mean investors are demanding more return for parking cash in "risk-free" Treasuries, communicating a broad aversion to tying up money anywhere. If bonds are unappealing, forget about risky bets like crypto—it's like trying to sell festival tickets during a thunderstorm. Yields need to drop, signaling cheaper money and a return to risk appetite, before crypto can rally. Right now, they're elevated, keeping the market in a holding pattern, with prices as flat as a bad DJ's set.

Crypto's priced in dollars, so the dollar's strength—tracked by the DXY index—is a massive bull run barometer. As of October 6, 2025, DXY's at around 98.11, a level that's kept crypto suppressed like a bad economy crushes dreams.

In past bull runs, DXY dipped into the low 90s, weakening the dollar and letting crypto prices inflate like a balloon at a kid's party. A strong dollar means cheap imports but expensive exports for risk assets—crypto stays low until DXY weakens, like waiting for the bouncer to look the other way before sneaking in the good stuff. This strength reflects tight liquidity and a flight to safety; only when it cracks will the bull charge.

The money printing on the horizon is going to be biblical, double the last cycle's haul. The U.S. is projected to issue $13.9 trillion in Treasury debt by 2026 to refinance and cover deficits, a number so vast it makes the COVID stimulus look like lunch money. This isn't just numbers on a screen—it's the Fed's cue to print like mad to keep yields down and the economy afloat. Globally, it's a debt apocalypse: China’s set for $13.3 trillion, Japan $2.4 trillion, and the Eurozone nearly $4 trillion, totaling $33.58 trillion in fresh borrowing from the world’s heavy hitters. That's more than double the last cycle's issuance, even though COVID was the excuse for the previous splurge. Governments are spending like it's 2020 all over again, but without the viral alibi, setting the stage for a liquidity flood that’ll make past QE look tame.

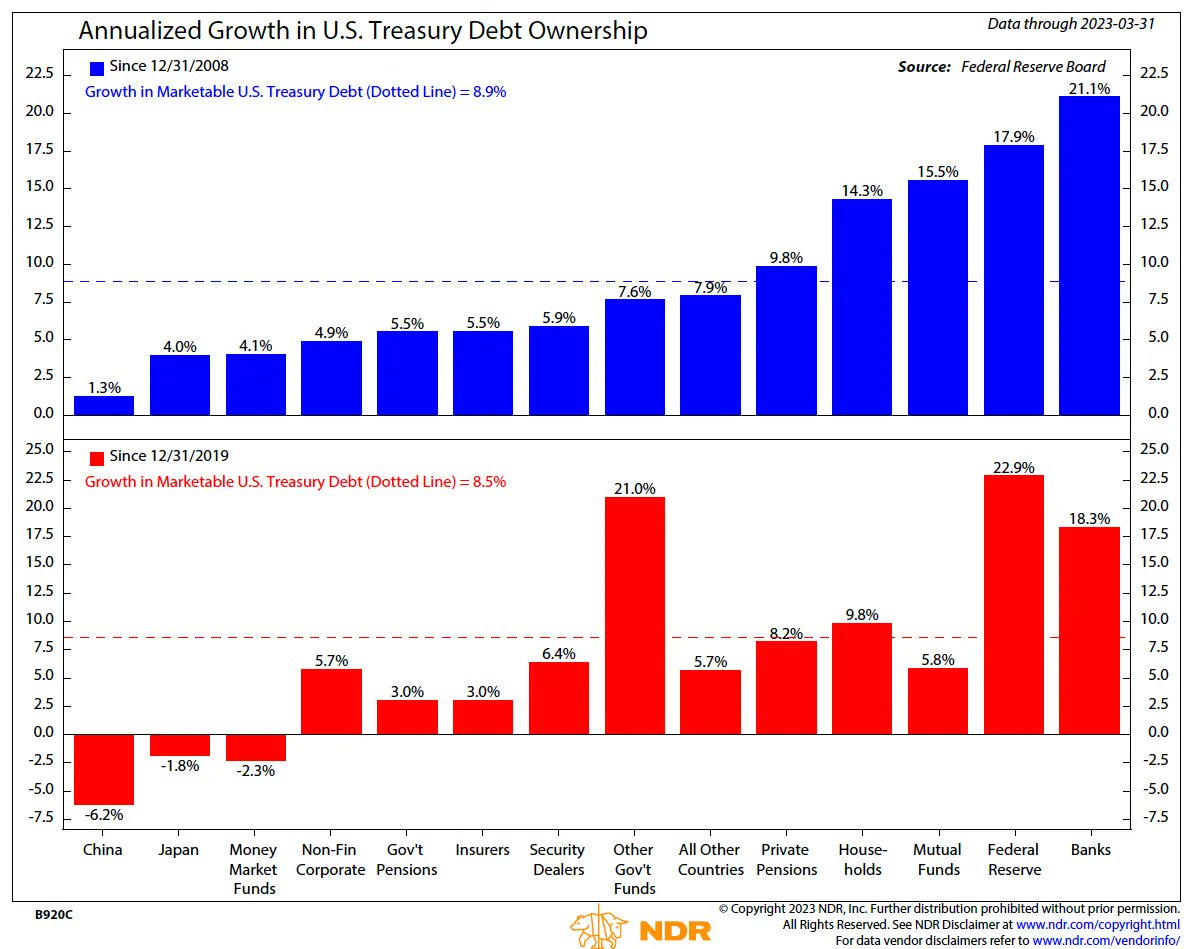

But here's the rub: nobody’s buying this debt deluge. In the old days, pension funds, foreign banks, and retail punters snapped up Treasuries like hotcakes. Now, it's mostly government funds, banks, and the Fed stepping in, like a family covering for a relative’s gambling habit. When banks and the Fed buy, they don’t dip into vaults—they print the money, weakening the dollar faster than a bad trade deal. This printing frenzy lowers bond yields, forcing investors to flee safe havens for riskier bets like crypto, because who wants 2% on bonds when inflation’s eating 5% of your cash? It’s the spark for bull runs, pushing asset prices up as dollars lose their mojo.

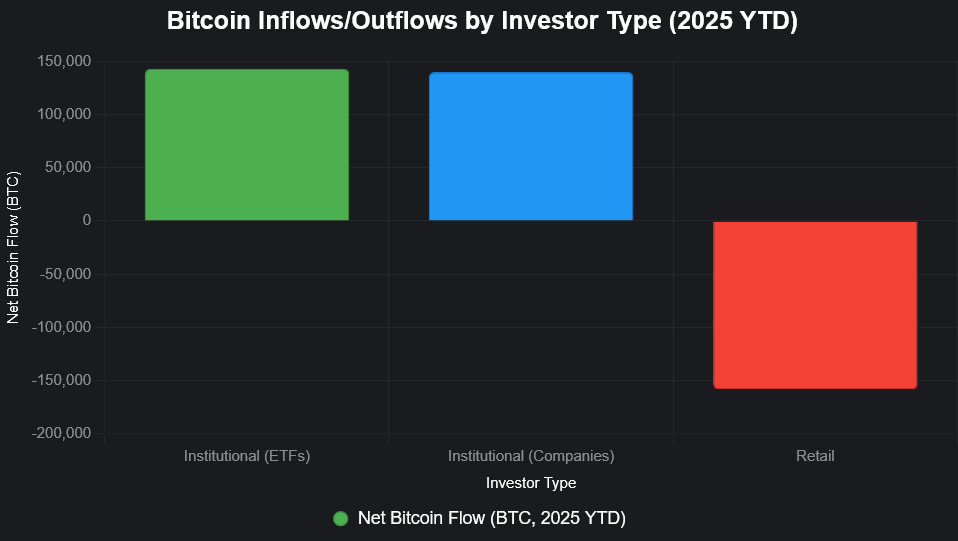

Institutions know this script inside out—that’s why they’re piling in now, setting up ETFs and hoovering up Bitcoin and Ethereum. In Q2 2025, Ethereum ETFs raked in over $13 billion in inflows, dwarfing Bitcoin’s $88 million, with players like BlackRock, Fidelity, and even World Liberty Finance leading the charge. As of late August 2025, spot Bitcoin ETFs saw $81.2 million in daily inflows, while Ethereum hauled $307 million in a single day. These aren’t retail rubes; they’re pros who don’t lose money, betting on the coming print-fest to ignite the real bull. BlackRock and Fidelity manage 85% of crypto ETF assets, totaling $123 billion, positioning for the liquidity wave.

So, no, the bull run hasn’t started—it’s early days, with institutions quietly stacking while the rest of us wait. If you FOMO in later, chasing headlines like a moth to a flame, you’ll just be exit liquidity for Larry Fink, Abigail Johnson, and the Trump family, cashing out while you’re left holding the bag. The evidence is clear: no QE, inverted yields, high Treasuries, strong dollar, and a debt tsunami incoming. The party’s brewing, but it hasn’t popped the cork yet. Get in smart, or get rinsed—your call in this crypto clown show.